Instalment payments explained

/As your business grows and your income increases, you’ll need to start making instalment payments for your taxes.

What does that mean?

When you’re just starting your practice, you’ll usually pay any taxes you owe when you file your taxes the following spring (so you’ll pay your 2025 taxes by April 2026). Once you get past a certain threshold of taxes, instead of paying all your taxes at once when you file your return, instalment payments mean you'll pay your taxes in smaller amounts throughout the year. In the example above, you would pay your 2025 taxes throughout 2025 instead of in April 2026.

If you do need to start paying in instalments, we’ll provide a schedule for your instalment payments. This schedule is generally based on your past two years of income. You can review our reporting letter from your 2024 tax return to check the instalment payments you need to make in 2025. The CRA may send you a different schedule, in which case you should follow that.

Here’s an example

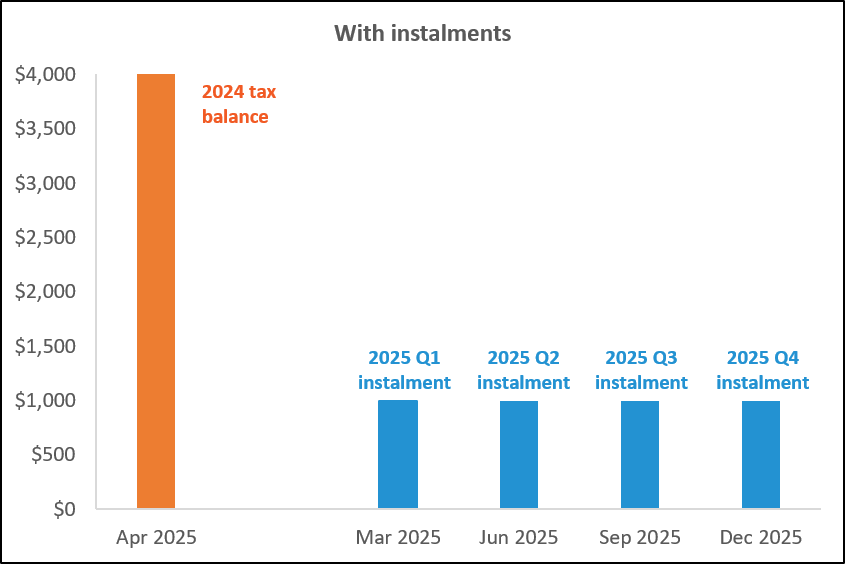

Let’s say you owe $4,000 for your 2024 taxes. You’ll have to pay that balance by April 30, 2025, as usual.

For your 2025 taxes, the CRA will now require you to prepay an estimate of your 2025 taxes. So instead of paying $4,000 in April 2026, you’ll pay $1,000 each quarter in 2025.

If your actual taxes for 2025 are higher, you’ll pay the difference in April 2026. And if your actual taxes are lower, you’ll get a refund in April 2026.

Do I have to pay them?

In general, yes. I mean, you don’t have to - but you’ll end up being charged interest and penalties if you don’t.

Paying instalments is a good sign. It shows your business is growing and you’re becoming a real business maven! Now you’ll have to pay taxes throughout the year, the same way employees have taxes deducted from their paycheques throughout the year.

So does this mean I’m paying tax twice?

Kind of, but not really. Let’s say 2025 is the first year you have to pay instalments. That means you have to pay your 2024 taxes by April 30, 2025 - and you’ll have to pay instalments towards your 2025 taxes throughout 2025. So you’re paying two years’ worth of taxes in 2025. But the 2025 instalments aren’t extra; instead it’s simply moving up the timing from April 2026 to throughout 2025.

What if my instalment payments are different from my actual amount owing?

This happens all the time. Your instalment payments are estimates based on the past couple years of your taxes. So if your practice is growing, you’ll usually end up with an additional balance owing in the spring because your instalment payments weren’t sufficient. This is typical and is the new norm for a growing practice. As long as you made the instalment payments you needed to, there’s no interest charged on this final payment.

On the other hand if you paid too much in instalments, you’ll receive the difference back as a refund.

What if my income is lower this year than last?

Since your instalment payment schedule is based on your previous two years’ income, you might be wondering what happens if your income is lower this year (due to parental leave or any other reason).

If your income is going to be lower, you might not have to pay as much in instalments. In that case you can certainly pay a lower amount, but the catch is that if you underestimate and pay too little, then the CRA will charge instalment interest on the portion you underpaid.

There's no right answer here, as it depends on your cash flow situation and your risk tolerance. Some people will pay the amount on the schedule and receive a refund in the spring, others will pay their best estimate, and others will just not make any instalment payments and pay the interest.

What about GST/HST?

Similar to income taxes, you’ll need to make instalment payments for your GST/HST account if you owed more than $3,000 the previous year. We’ll let you know if you may need to pay in instalments on your previous year’s GST/HST return. For example, check your 2024 GST/HST return to see if you need to make instalment payments for 2025.

Your GST/HST instalment payments are usually due April 30, July 31, October 31 and January 31 each year.